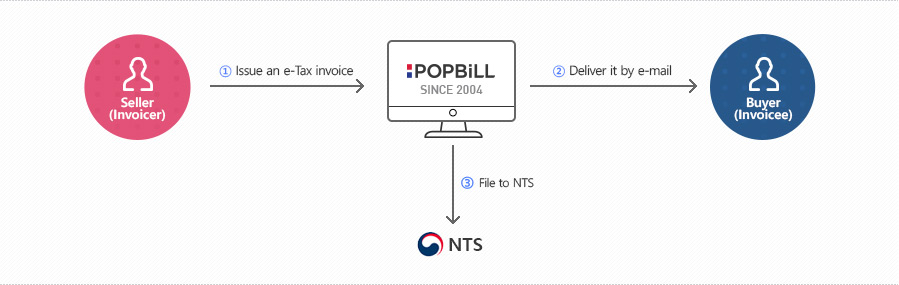

How to issue

Seller fills out required values of e-Tax invoice and issues it making e-Signature by proper certificate. At the same time, a notification mail is sent to customer(buyer). Issued e-Tax invoice is going to be filed to NTS in accordance with NTS filing policy user set.

Notices

- - Prior to test the process of issuing e-Tax invoices, a user(seller)'s certificate must be registered in POPBiLL Test-bed.

- - In Test-bed, issued e-Tax invoice isn't filed to NTS actually. Process 'File to NTS' is a kind of mock process so only filing result is going to be changed to 'Success'.

- - Even in Test-bed, the notification mail is sent to a customer(buyer) actually. Must use another e-mail address for the issuance test.

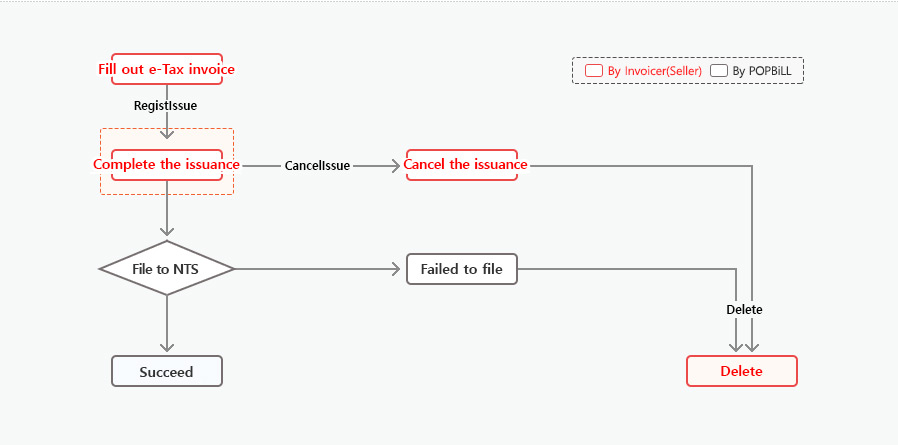

Flow Chart

Invoicer(Seller) saves the information of e-Tax invoice and issues it calling 'RegistIssue' API. User can get a filing result within 20 minute(Maximum : 30 min) from the time the filing started. To cancel the e-Tax invoice is available only before the filing starts and to issue a revised invoice is required to cancel or modify after the filing starts.

Identification Numbering System

Identification numbering system is designed for management of e-Tax invoices. First, the user configures 'Seller Invoice ID'(invoicerMgtKey) and sends invoice data with it to POPBiLL. Then, POPBiLL assigns 'POPBiLL Invoice ID(itemKey)' matching with 'Seller Invoice ID'. When the e-Tax invoice is issued, POPBiLL do assigns 'NTS Confirm Number'(ntsCofrimNum) to file to NTS and it is used for searching in NTS.

| Management Authority |

Type | Variable Name | Length | Description |

|---|---|---|---|---|

| User | Seller Invoice ID | invoicerMgtKey | 24 |

A unique value combined English letter,

numeric, hyphen(‘-’) and underbar(‘_’) |

| POPBiLL | NTS Confirm Number | ntsConfirmNum | 24 |

It’s assigned at the time when issuance is

completed, not filing is completed |

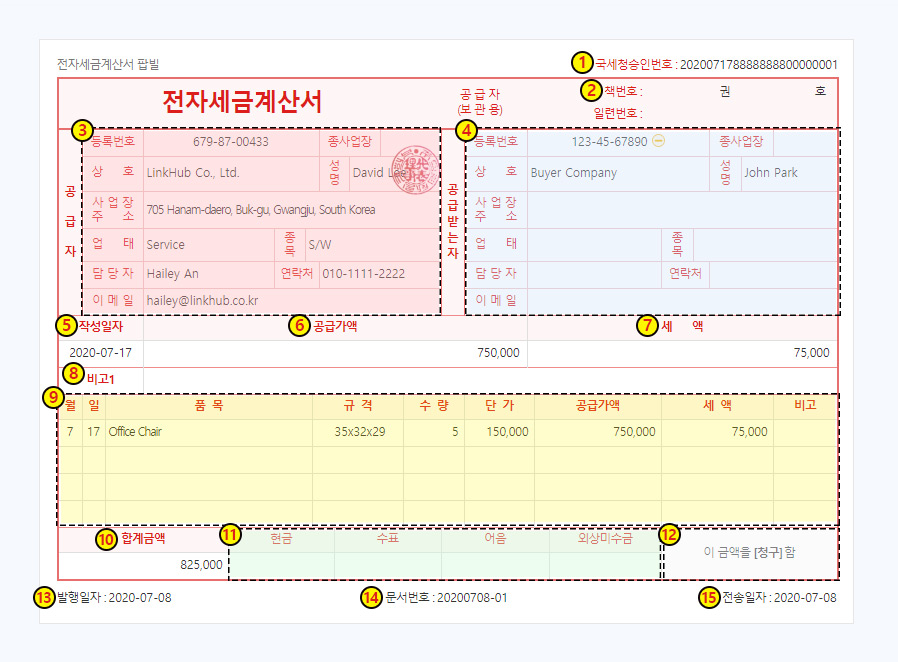

Example of e-Tax invoice

- 1. NTS Confirm Number(국세청승인번호)

- 2. Book Number(책번호) : kwon(권), ho(호) | Serial Number(일련번호)

-

3. Seller's Information(공급자정보)

- (a) Business Registration Number(등록번호)

- (b) Identification Number for minor place of business(종사업장)

- (c) Name of company(상호) / representative(성명)

- (d) Address(사업장주소)

- (e) Business Type(업태) | Business Item(종목)

- (f) Name of the person in charge(담당자) | Contact(연락처)

- (g) Email(이메일) - 4. Buyer's Information(공급받는자 정보)

- 5. Date of preparation(작성일자)

- 6. Sum of supply values(공급가액)

- 7. Sum of tax amount(세액)

- 8. Note(비고) : Available up to 3 notes

- 9. Information of line items : Month(월) | Date(일) | Name/Description(품목) | Specification(규격) | Quantity(수량) | Supply values(공급가액)

Tax Amount(세액) | Remark(비고) - 10. Total Amount(합계금액)

- 11. Payment Method : Cash(현금) | Check(수표) | Credit(어음) | Note(외상미수금)

- 12. Type of Total Amount : Amount paid(영수) | Amount due(청구) | None(없음)

- 13. Date of issuance(발행일자)

- 14. Seller Invoice ID(문서번호)

- 15. Date of filing(전송일자)

Business Contact

For more help with POPBiLL, try these resources :

T. +82 70-7998-7117E. global@linkhubcorp.com