POPBiLL e-Tax invoice API (REST API+JSON)

It's an API service to issue the e-Tax invoice and file to NTS within integrated customer's system. Customers can easily use the e-Tax invoice API service and implement integration system calling functions of SDK provided by POPBiLL.

- Typee-Tax Invoice(Taxation/Zero-rate), e-Invoice(Tax exemption)

- Method of issuanceIssuance by invoice(seller), invoicee(buyer), consignee

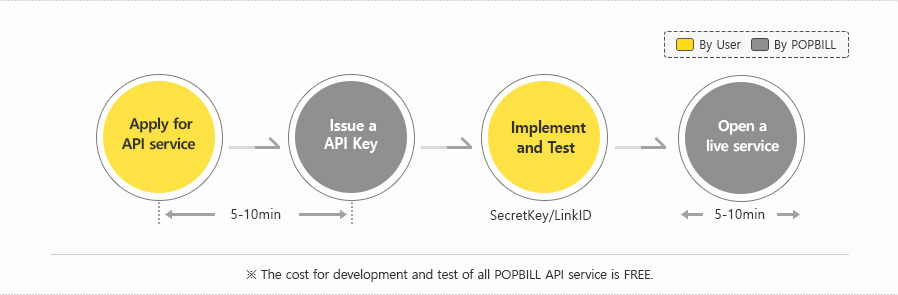

Process of API service introduction

1) Applying for API service: The user applies for API service to get a API Key(SecretKey/LinkID) assigned from POPBiLL.

2) Implementation and Test: Setup the API Key in SDKs referring to the tutorial. In Testbed, user can implement the integration system and test functions under the same conditions of PROD(live service)

POPBiLL API Key

- SecretKey: a unique identification information to prevent from falsifying the data and make a secured API networking between POPBiLL and user.

- LinkID: a unique property to recognize the user that directly make a contract with POPBiLL and identify a permitted user's customer.

Specialities of POPBiLL e-Tax invoice API

01

All functionalities of POPBiLL services are provided

as API

02

Support all DBMS and OS (provide individual SDKs

+ online manual per service/development language)

03

Highly secured mutual authentication system

implemented by POPBiLL original technology

(HMAC+Bearer Token+Own method)

04

Data encryption through all network path

05

Deliver real-time information automatically

using Webhook service

06

Customizable functions to fulfill user’s

requirement and preference

Business Contact

For more help with POPBiLL, try these resources :

T. +82 70-7998-7117E. global@linkhubcorp.com